Picture this: you're a talented creative professional who's brilliant at turning artistic vision into reality, but when it comes to understanding where your money's actually going, you feel like you're trying to read sheet music in the dark. You know you're spending on materials, equipment, and time, but tracking these costs feels like trying to tune a guitar with broken strings. Enter cost accounting – the financial backstage crew that helps you understand exactly where every dollar is being spent, so you can turn up the volume on profitability.

Cost accounting isn't just another boring financial concept that traditional accountants love to ramble on about. It's actually a powerful tool that can help creative businesses understand their true costs, set profitable prices, and make strategic decisions that amplify success. Unlike your standard financial accounting that focuses on historical reporting for external stakeholders, cost accounting is all about internal decision-making and operational efficiency – making it perfect for creative professionals who need real-time insights to keep their businesses rocking.

Cost accounting serves as the sound engineer for your business finances, fine-tuning every expense to create the perfect mix of profitability and efficiency. At its core, cost accounting is a systematic approach to tracking, analysing, and allocating all costs associated with producing your creative work or services. Think of it as having a detailed roadmap that shows exactly where your money goes during each project, from the initial concept to final delivery.

The beauty of cost accounting lies in its flexibility. Unlike financial accounting, which must follow strict Australian Accounting Standards, cost accounting can be customised to fit your unique creative business model. Whether you're a graphic designer tracking time across multiple client projects, a photographer calculating the true cost of each shoot, or a marketing agency trying to understand which services generate the highest margins, cost accounting gives you the backstage access to your financial performance.

For creative professionals, this discipline becomes particularly powerful because it helps distinguish between fixed costs (like studio rent and equipment depreciation) and variable costs (like materials and freelance talent). A graphic design studio might discover that their premium branding projects require 40% more time than initially estimated, leading to adjusted pricing strategies that protect profitability whilst maintaining competitive positioning.

The strategic advantage becomes clear when you consider that cost accounting emerged during the Industrial Revolution specifically to address the complexities of modern business operations. Today's creative economy faces similar challenges – multiple revenue streams, project-based work, fluctuating resource requirements, and the need for precise profitability analysis across different service offerings.

Think of financial accounting as your business's greatest hits album – it's the polished, standardised version that gets released to the public (investors, banks, and the Australian Taxation Office). Cost accounting, on the other hand, is like your recording studio sessions – raw, detailed, and focused on the creative process itself rather than the final public presentation.

Here's a comparison that breaks down the key differences:

| Aspect | Cost Accounting | Financial Accounting |

|---|---|---|

| Primary Audience | Internal management and decision-makers | External stakeholders (investors, ATO, banks) |

| Reporting Standards | Flexible, customised to business needs | Must comply with Australian Accounting Standards |

| Frequency | Real-time to daily reporting | Quarterly and annual reporting |

| Focus | Operational efficiency and cost control | Historical financial performance |

| Detail Level | Granular project and activity costs | Summarised financial statements |

| Purpose | Strategic planning and pricing decisions | Compliance and external communication |

For creative businesses, this distinction matters enormously. Your financial accounting might show that your design agency generated $500,000 in revenue last year with a 20% profit margin. Your cost accounting, however, reveals that wedding photography projects actually lose money due to underpriced packages, whilst corporate branding work delivers 35% margins. This level of insight allows you to remix your service offerings for maximum profitability.

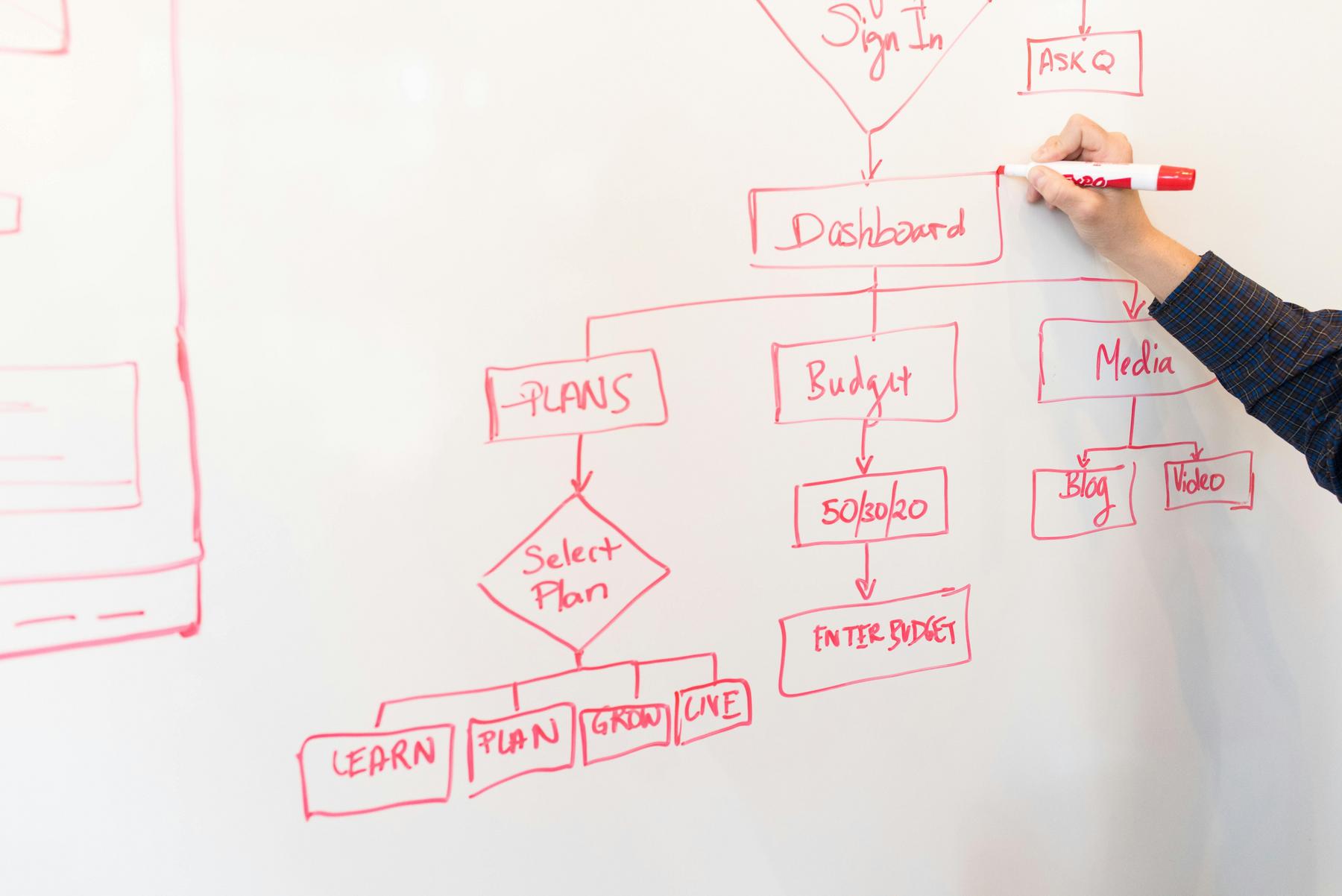

The integration between these two accounting approaches creates a complete financial picture. Whilst your financial accounting ensures compliance with Australian tax regulations and provides historical performance data, cost accounting becomes your real-time financial dashboard, helping you make informed decisions about pricing, resource allocation, and business strategy.

Just as musicians have different genres and styles, cost accounting offers various methodologies, each suited to different business models and information needs. Understanding these approaches helps creative professionals choose the right method for their unique circumstances.

Standard Costing operates like having a predetermined setlist for each performance. You establish standard costs for materials, labour, and overheads, then compare actual performance against these benchmarks. A video production company might set standard costs of $200 per hour for editing, $150 for equipment rental, and $500 for location fees. When actual costs vary from these standards, variance analysis reveals whether projects are running over budget due to inefficiencies or external factors.

Activity-Based Costing (ABC) functions like a detailed breakdown of every instrument and sound effect in a complex musical arrangement. Instead of broadly allocating overhead costs, ABC traces expenses to specific activities that drive resource consumption. A marketing agency using ABC might discover that social media campaigns consume 30% of their creative team's time but only generate 15% of revenue, prompting strategic discussions about pricing or service mix.

Marginal Costing focuses on the incremental cost of producing one additional unit, similar to understanding the cost of adding one more song to an album. This method particularly benefits creative businesses with scalable services. A web design agency might calculate that their marginal cost for an additional website page is $50 in design time, whilst charging $200, creating a healthy contribution margin that covers fixed costs and generates profit.

Lean Accounting embraces the philosophy of eliminating waste, much like a minimalist approach to music production that focuses only on essential elements. This methodology tracks costs in real-time and eliminates non-value-adding activities. A photography studio implementing lean accounting might reduce equipment storage costs by 15% through better inventory management and workflow optimisation.

Each method offers distinct advantages depending on your business model, project complexity, and information requirements. Many creative businesses benefit from combining approaches – using ABC for detailed project costing whilst employing marginal costing for pricing decisions.

Creative industries face unique challenges that traditional cost accounting methods weren't necessarily designed to address. Project-based revenue, fluctuating freelance costs, intellectual property development, and irregular workflow patterns require adapted approaches that resonate with the creative business model.

Project-Based Costing emerges as particularly relevant for creative professionals. This approach treats each client project as a distinct cost centre, tracking all associated expenses from initial consultation through final delivery. A branding agency working on a complete corporate identity might allocate research time, design iterations, client meetings, and production costs to that specific project, revealing true profitability and informing future pricing decisions.

Modern technology amplifies these capabilities through platforms like Xero Projects and MYOB's job management software, which enable real-time tracking of billable hours, expenses, and project profitability. These tools become particularly valuable for creative businesses juggling multiple concurrent projects with varying complexity levels and resource requirements.

Accrual-Based Recognition proves essential for creative businesses with longer project timelines. A film production company might use accrual accounting to recognise income upon project completion rather than payment receipt, ensuring accurate profit reporting that aligns expenses with corresponding revenue. This approach provides clearer insights into project profitability and business performance trends.

For smaller creative businesses, simplified cash-based approaches combined with job costing can provide sufficient detail without overwhelming administrative burden. A freelance photographer might track costs by shoot type (weddings, corporate events, portraits) whilst maintaining straightforward cash flow management that satisfies Australian taxation requirements.

The key lies in selecting methods that provide actionable insights without creating excessive administrative overhead. Creative businesses often benefit from hybrid approaches that combine detailed project tracking with simplified overhead allocation, maintaining focus on creative output whilst ensuring financial visibility.

Cost accounting transforms from a mundane financial exercise into a strategic amplifier for business growth when implemented thoughtfully. The insights generated through systematic cost tracking enable creative professionals to make informed decisions that directly impact profitability and long-term sustainability.

Pricing Strategy Optimisation represents one of the most immediate benefits. Many creative professionals struggle with pricing their services appropriately, often undervaluing their work or failing to account for all associated costs. Cost accounting provides the data foundation for evidence-based pricing decisions. A graphic designer discovering that logo projects require an average of 12 hours including revisions, client communication, and administration can confidently price these services to ensure profitable outcomes.

Resource Allocation Efficiency becomes particularly powerful when you understand which activities generate the highest returns. Activity-based costing might reveal that a marketing agency's content creation services deliver 40% higher margins than social media management, justifying increased focus and resources in that area. This data-driven approach prevents the common mistake of pursuing revenue growth in low-margin activities.

Break-Even Analysis provides crucial insights for business planning and risk management. Understanding that your photography studio needs to complete 15 wedding shoots per month to cover fixed costs helps with capacity planning and marketing investment decisions. The formula for break-even analysis becomes:

Break-Even Quantity = Fixed Costs ÷ (Price per Unit - Variable Cost per Unit)

Waste Reduction and Process Improvement opportunities emerge through detailed cost tracking. A video production company might discover that equipment transportation accounts for 8% of project costs, leading to investment in local equipment partnerships or more efficient logistics planning.

The strategic advantage compounds over time as cost accounting data enables trend analysis, seasonal planning, and growth opportunity identification. Creative businesses armed with detailed cost insights can negotiate supplier arrangements, optimise service packaging, and make confident investment decisions that amplify long-term profitability.

Implementing cost accounting in creative businesses isn't always a smooth performance – there are potential discord notes that creative professionals should anticipate and prepare for. Understanding these challenges helps set realistic expectations and develop effective implementation strategies.

Time Allocation Complexity represents a significant challenge for project-based creative work. Unlike manufacturing environments where time tracking is relatively straightforward, creative projects involve conceptual thinking, client communication, revisions, and administrative tasks that can be difficult to categorise and allocate accurately. A web designer might spend two hours brainstorming concepts – should this be allocated to the current project or treated as general business development?

Overhead Allocation Dilemmas become particularly complex in creative industries where shared resources support multiple projects simultaneously. How do you allocate studio rent, software licences, and equipment depreciation across different client projects? Traditional allocation methods based on direct labour hours might not reflect actual resource consumption, potentially distorting project profitability analysis.

Technology Integration Challenges can create frustration when existing systems don't communicate effectively. Many creative professionals use specialised software for project management, time tracking, and invoicing that may not integrate seamlessly with accounting platforms. This fragmentation can lead to duplicate data entry and increased administrative burden.

Behavioural Resistance often emerges when creative team members view detailed time tracking and cost allocation as bureaucratic interference with their creative process. The key lies in demonstrating how cost accounting insights support rather than hinder creative freedom by ensuring projects remain profitable and sustainable.

Data Accuracy and Consistency requires ongoing attention and discipline. Inconsistent time tracking, delayed expense recording, or incomplete project cost allocation can undermine the reliability of cost accounting insights. Establishing clear procedures and regular review processes helps maintain data quality whilst minimising administrative burden.

The solution involves implementing cost accounting gradually, focusing initially on high-impact areas like project profitability analysis before expanding to more detailed activity-based costing. Many successful creative businesses start with simplified approaches and evolve their cost accounting sophistication as their understanding and administrative capabilities develop.

Cost accounting emerges as an indispensable tool for creative professionals seeking to transform artistic passion into sustainable business success. Unlike traditional financial reporting that focuses on historical performance for external stakeholders, cost accounting provides the real-time insights and strategic intelligence needed to optimise operations, enhance profitability, and make informed business decisions.

The evolution from Industrial Revolution manufacturing applications to modern creative industry implementations demonstrates cost accounting's adaptability and continued relevance. Today's creative businesses benefit from sophisticated yet accessible tools that enable project-based tracking, resource allocation analysis, and strategic planning without overwhelming administrative burden.

Success lies in selecting appropriate methodologies that align with your specific business model and information needs. Whether implementing activity-based costing for detailed project analysis, standard costing for performance benchmarking, or simplified job costing for streamlined tracking, the key involves maintaining focus on actionable insights rather than administrative complexity.

The integration of modern technology platforms with traditional cost accounting principles creates unprecedented opportunities for creative businesses to achieve financial precision whilst maintaining creative freedom. Real-time dashboards, automated allocation procedures, and sophisticated analytics enable informed decision-making that amplifies both creative output and financial performance.

As creative industries continue evolving and becoming increasingly competitive, businesses armed with detailed cost insights gain strategic advantages in pricing, resource allocation, and growth planning. Cost accounting transforms from a necessary administrative function into a strategic amplifier that enables creative professionals to focus on what they do best whilst ensuring long-term financial sustainability.

Implementation costs vary significantly depending on business size and complexity requirements. Small creative businesses can start with basic job costing features in platforms like Xero or MYOB for $30-60 monthly, whilst larger agencies might invest $200-500 monthly for comprehensive project management and cost tracking solutions. The key lies in starting simple and expanding capabilities as your business grows.

Regular bookkeeping focuses on recording transactions and maintaining compliance with Australian taxation requirements, whilst cost accounting analyzes how money is spent across different projects and activities. Bookkeeping tracks that you spent $500 on design software; cost accounting reveals how that software cost should be allocated across various client projects to understand true project profitability. Both functions complement each other in comprehensive financial management.

Absolutely. Cost accounting becomes particularly valuable during challenging economic periods by identifying which services or projects generate the highest margins, where costs can be reduced without impacting quality, and how to optimise pricing strategies. During downturns, creative businesses with detailed cost insights can make informed decisions about service mix, resource allocation, and strategic positioning that help maintain profitability whilst competitors struggle.

Most creative businesses benefit from monthly detailed reviews combined with weekly dashboard monitoring for active projects. Monthly reviews allow analysis of trends, profitability patterns, and strategic adjustments, whilst weekly monitoring ensures projects stay on budget and identifies issues before they impact profitability. The frequency should balance actionable insights with administrative efficiency.

Yes, even solo creative professionals benefit from basic cost accounting principles. Understanding true project costs, hourly rates that cover all business expenses, and which types of work generate the highest returns helps freelancers make strategic decisions about pricing, client selection, and service development. Simple time tracking and project costing can significantly improve profitability without requiring complex systems.

Sign up to receive relevant advice for your business.