As Christmas time is all about the gift of giving, many businesses like to host a Christmas party or provide gifts for their employees and clients. I'm sure you do too which is awesome. You go, Santa!

But what a lot of business owners don't know is that all those beers at the annual Christmas party can be taxing on more than your liver.

This is because a sneaky little pain in the ass tax known as Fringe Benefits Tax (FBT) applies to business that provide "benefits"... such as Christmas parties and gifts.

If you're not careful, FBT implications can result in significant costs to your business so let's take a quick look into it shall we?

A "fringe benefit" is paid by employers on certain benefits that they provide to their employees, employees' family members and other associated parties and is separate from salary or wages.

In plain English, fringe benefits are the provision of "non-cash benefits". These non-cash benefits are then subject to tax, hence fringe 👏 benefits 👏 tax 👏!

Yeah, basically.

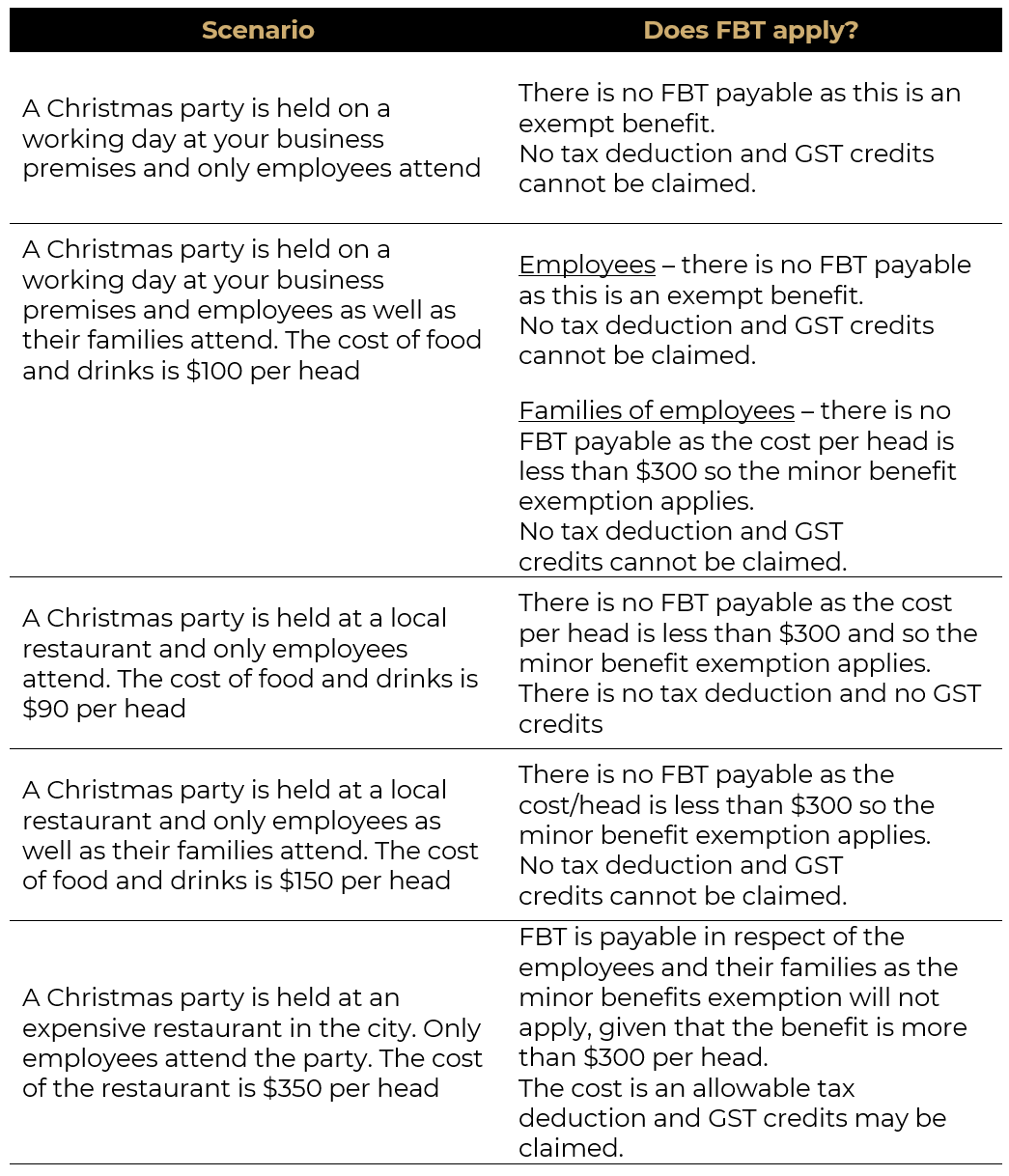

It sucks, but because there is technically no specific FBT category for Christmas parties there are a few things we need to look out for to determine whether or not your Christmas party or providing gifts will attract additional tax.

Here is a breakdown of 3 key things to consider when determining if your Christmas party is going to be subject to FBT.

The ATO will first draw a distinction between your Christmas party being considered "entertainment" or "non-entertainment".

… I know, right! Stick with me here.

If your Christmas party is held on your work premises, the ATO is more likely to consider your Christmas party as being exempt from FBT. Just note that hosting your party in-house does not necessarily guarantee an exemption from FBT because we must consider the ATO guidelines on what "entertainment" actually is. In this case, it could be:

Generally speaking, the costs for food and drink for a Christmas party will be exempt from FBT if they are provided on a working day, on business premises and consumed by employees only.

So as with all rollercoaster tax regimes, each Christmas party should be assessed on individual facts in conjunction with interpretation of the rules. With more to follow!

Simply put, the ATO provides a minor benefit exemption - so basically any benefit provided up to no more than $300 is exempt from FBT.

True to ATO form, there are some conditions that apply to this exemption but the main one to consider here is that a minor benefit must be "infrequent and irregular".

So no weekly Christmas parties, Party Man Sam! 🕺

Provided that your Christmas party is a one-off (lol, of course it is) and the cost per employee is less than $300, the party will be considered a minor benefit and exempt from FBT.

This minor exemption will also extend to families of your employees, should they be lucky enough to be invited to attend.

Gifting makes things a little trickier. Trust the ATO to make the act of spreading Christmas cheer difficult 🙄

The first key here is to determine whether the gift may be considered "entertainment" or "non-entertainment".

Following that, tax treatment (if any) will differ depending on who is receiving the gift. Clients or employees.

It works like this:

Things that may be considered "entertainment" include movie tickets, gig tickets and holiday vouchers.

These items may be subject to FBT and/or non-deductible for tax purposes when considering the cost threshold and who is receiving the gift.

Things that may be considered "non-entertainment" include Christmas hampers, gift vouchers and chocolates. Gifts of alcohol is included here as non-entertainment but only if it is consumed away from the workplace!

These items may not be subject to FBT and/or may be deductible for tax purposes when considering the cost threshold and who is receiving the gift.

Head spinning? If you take anything from the above, providing clients and employees with "non-entertainment" gifts that cost less than $300 will give you the best tax outcome 🤓

Short and sweet - the cost of providing a Christmas party for your rockstar employees and fans is tax deductible only to the extent that the party is subject to FBT. Any costs that are exempt from FBT cannot be claimed as a tax deduction.

There are a lot of moving parts to navigate for something as awesomely fun as a Christmas party. Just remember to consider the following:

If you are having trouble or want to understand more about how tax makes its way into each Christmas please contact us for a 30 minute meeting so we can talk you through the details and ensure you are making plans for something that will be both insanely fun and tax effective!

Sign up to receive relevant advice for your business.